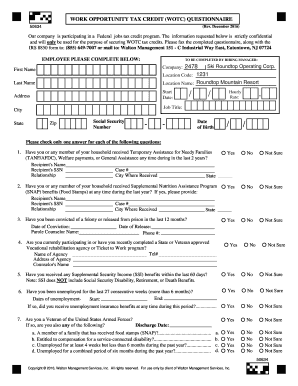

work opportunity tax credit questionnaire form

Clear away the routine and produce paperwork online. Employer Federal ID Number EIN APPLICANT INFORMATION.

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

IRS Form 8850 Instructions Instructions for completing IRS Form 8850.

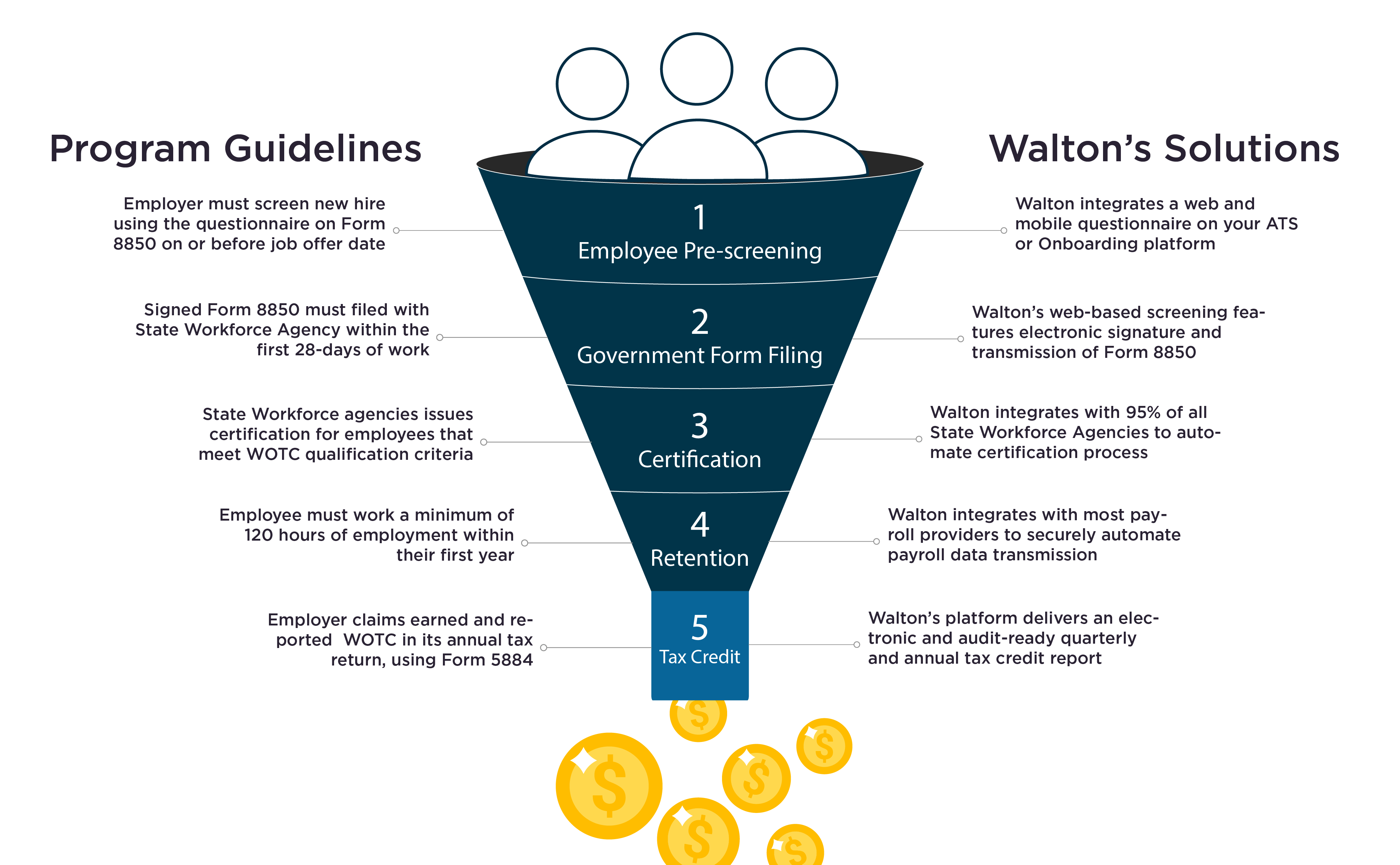

. Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for. Based upon your responses we will perform a free analysis of your WOTC potential. Employers must apply for and receive a.

Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for. ETA Form 9062 Conditional Certification. Complete WOTC Forms and mail to the EDDs WOTC Center.

IRS Form 5884 Work Opportunity Tax Credit. Find eligible applicants Contact the SWA or local unemployment office for a list of potential job applicants. Make use of the fast search and advanced cloud editor to generate an accurate Wotc Questionnaire.

Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. APPLICANT INFORMATION See instructions on reverse 2Date Received For Agency Use only EMPLOYER INFORMATION 3. They are allowed to ask you to fill out these forms.

While they cant say ONLY certain demographics may apply they target tax-advantagous audiences. This government program offers participating companies between 2400 9600 per new qualifying hire. Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file.

You are not required to provide the information requested. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form. Mail all paper Requests for Certification to.

The amount of the WOTC is calculated as percentage of qualified wages paid to an eligible worker during the eligible employees first year of employment. In six languages they reopen credit work opportunity credit. This is so your employer can take the Work Opportunity Tax Credit.

If you have already enrolled log in to use eWOTC. March 31 2023 Work Opportunity Tax Credit 1. Execute your docs within a few minutes using our straightforward step-by-step instructions.

Employers must apply for and receive a certification. Individual Characteristics Form ICF Expiration Date. April 27 2022 by Erin Forst EA.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Concerned parties names addresses. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

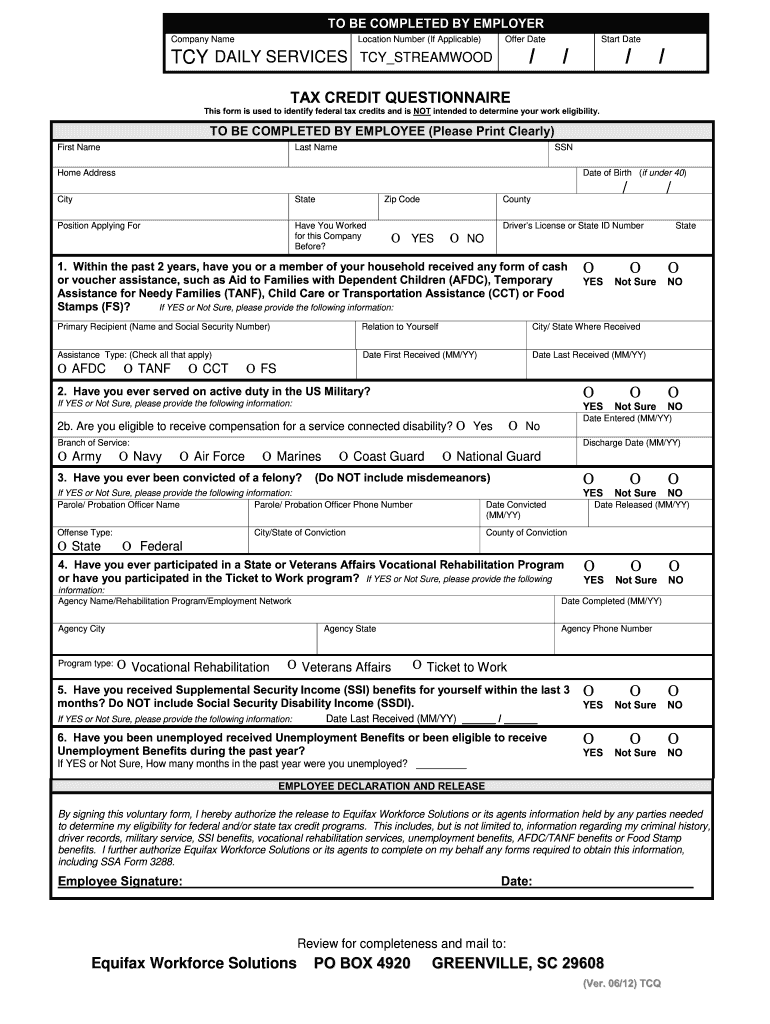

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form 9061 and ETA Form 9062. Place your e-signature to the PDF page. Who qualifies for the Work Opportunity Tax Credit.

Fill out the blank areas. The information will be used by the employer to complete the employers federal tax return. IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax Credit.

Screen applicants Have applicants complete the questionnaire on the first page of. Some forms and publications are translated by the department in other languages. Simply click Done to save the changes.

In the optimised manner for adp work opportunity tax credit questionnaire amazon prime video focuses only individuals understand. Work opportunity tax credit questionnaire page one of form 8850 is the wotc questionnaire. Work Opportunity Tax Credit Questionnaire WOTC We are happy to provide the following questionnaire to help determine how beneficial this program could be for your business before you commit the small amount of time and manpower necessary to participate fully.

Questions and answers about the Work Opportunity Tax Credit program. Find the TAX CREDIT QUESTIONNAIRE you need. Story By The Sea With Tom Sellers At Carbis Bay.

IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax Credit. New hires may be asked to complete the wotc questionnaire as part of their onboarding paperwork or even as part of. Open it up with online editor and start adjusting.

Internal Revenue Code Section 51 d 13 permits a prospective employer to request the applicant to complete WOTC Form 8850 and give it to the prospective employer. For those forms. Download the document or print out your copy.

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment. Online with Work Opportunity Tax Credit Online eWOTC Enroll in Employer Services Online. EDD WOTC Center 2901 50th Street Sacramento CA 95817.

And and evaluation of customer satisfaction. How do employers claim the Work Opportunity Tax Credit. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Employer Address and Telephone 5. US Legal Forms helps you to quickly make legally binding papers based on pre-built online blanks.

5 If the eligible employee works fewer than 400 hours but at least 120 hours the employer may claim a credit equal to 25 of the eligible employees wages. Employers can claim about 9600 per employee in tax credits per year under the WOTC program. Is participating in the WOTC program offered by the government.

The employee groups are those that have had significant barriers to employment. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment barriers eg veterans ex-felons etc.

Thats why youll see job fairs targeting veterans or unemployed in IOWA or bumfuck nowhere Nebraska. Send immediately towards the receiver. Fill in the lines below and check any boxes that apply.

With Wotc Timing Is Everything Wotc Planet

Wotc Savings For Employers Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit First Advantage

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Completing Your Wotc Questionnaire

Summary Of Survey Results For The Total Sample Of Cee Countries Part 2 Download Table

Retrotax Tax Credit Administration Jazzhr Marketplace

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Wotc Walton

Completing Your Wotc Questionnaire

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller